2026 Predictions

The Setup

We are now three years into the AI trade, and the question everyone is circling is ROI. We are unlikely to get a clean, definitive answer in 2026. In a skittish market, stocks will move on what investors believe are the best leading indicators.

Historically, the market focused on the “I” side of the equation - Nvidia revenue as a proxy for AI investment. That focus is quietly shifting to the “R” side - OpenAI’s revenue / ARR / funding rounds, at least until we have other sizable, trackable sources of AI revenue.

This matters. The market increasingly wants proof that AI is not just capex-heavy, but revenue-generating.

2026 may also be the first year the AI trade meaningfully splits into AI infra vs. AI applications. Clear winners on the application side should continue to get bid up. Losers, or companies where AI raises terminal-value risk, may keep getting punished.

Big Themes and Catalysts Into 2026

1. Self-Driving

I am biased :). But 2026 feels like a breakout year:

Waymo could ~2-3x its fleet with ~50% cost reductions; Aurora could scale to hundreds of fully driverless trucks, again with ~50% cost reductions; Tesla Robotaxi may finally prove itself.

Self-driving is one of the largest AI applications by potential rev and economic impact. It also matters to everyone, not just white-collar workers.

Implications for mobility, logistics, and service providers?

2. Multimodal AI

Been listening to Demis on this: “Built from the ground up multimodal”; “Chatbots are a temporary UI”; “Truly multimodal includes touch”; “AI that creates interactive simulations, not just video”, etc.

I may still be underestimating this, but at a minimum we may get: AI-generated video gets longer (1 hour?)? AI-generated short or tailored videos to explain long-form content? Localization becomes dramatically cheaper?

Meta and Google (and Tesla?) have uniquely advantaged multimodal datasets. Their progress here is critical to watch.

Expect much more discussion around “world models.”

Short-form, AI-assisted video to take share from traditional long-form entertainment?

3. Edge AI

Apple finally shows its hand with an AI-powered Siri launch in the spring

Expect louder debates around edge compute vs. hyperscaler capex

4. Enterprise AI Adoption

OpenAI is shifting more aggressively toward enterprise in 2026.

What does rising vertical specialization and agent adoption mean for incumbents?

If Google and OpenAI both push hard here, what happens to Microsoft Office?

Is SaaS structurally a winner, or getting completely disintermediated?

5. Space

A potential SpaceX IPO (per public reporting) could ignite enthusiasm for the space theme. This could create both long and short opportunities

Would not be surprised to see “space” crowd out other retail-favored themes (energy, quantum, crypto, etc.)

6. Agentic Commerce

Both GPT and Gemini are pushing here.

How much GMV can agentic commerce realistically capture?

How does Amazon respond? Now that Shopify and Walmart are already “in it”

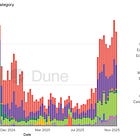

What happens to the ads revenue pool as commerce workflows change?

7. AI in the Real Economy

Quoting our friends at TMT Breakout:

On average, every 1% reduction in labor costs for the S&P 500 implies ~2% upside to EPS. Healthcare, consumer staples, and consumer discretionary benefit more than the index on average.

Importantly, many S&P 500 companies are now quantifying AI’s impact, not just talking about it.

Other Themes/ Catalysts to Watch

IPOs or IPO prep: SpaceX, OpenAI, Anthropic (based on public reporting)

Prediction markets: With the 2026 World Cup in the US, how much share can prediction markets take from traditional sports betting?

Robotics and world models: Possible policy announcements, plus early attempts to put robots into homes in 2026

Rate-cut beneficiaries

China:

Potential IPOs like MiniMax or Unitree (per media)?

Possible Trump visit; US-China diplomatic developments?

Creative consumer AI applications from China?

AI Model Progress Into 2026

KEY: Monitor performance improvements from models trained on Blackwell (1H26)

Coding and Agents

Longer-form tasks completed end-to-end

Some labs (e.g. Anthropic) openly aiming to replace low-end developers in 2026

Potential Buzzwords on the Frontier Research

World models

Continuous learning

Infinite context windows

Multi-agent systems

Macro Backdrop

Positives

Rate cuts, potentially accelerated under a new Fed chair

Fiscal stimulus (OBBB, likely 100bps+ equivalent)

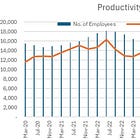

Early signs of AI-driven productivity gains (still debatable)

US midterm election dynamics

Risks

A shrinking labor pool and rising jobless data

Stickier-than-expected inflation

Tech vs. Non-Tech

Historically, roughly every four years, non-tech outperforms tech. Non-tech tends to win when: Rates rise; Inflation or reflation shows up; Commodities and industrials lead; Valuation mean reversion or Markets risk-off

The Open Debates

Can Tesla actually succeed with robotaxi?

Does Apple’s new Siri surprise to the upside, or disappoint?

Can Meta produce a true SOTA model?

Where does multimodal development ultimately lead?

How much does Blackwell really move the model performance curve?

Will ASICs meaningfully challenge GPUs?

Is digital advertising zero-sum?

Even if Google has a tier-1 model, does it still lose share as OpenAI and TikTok enter?

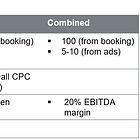

Can OpenAI successfully build ads and commerce businesses? Can the model companies maintain high growth rates?

The information presented in this newsletter is the opinion of the author and does not necessarily reflect the view of any other person or entity, including Altimeter Capital Management, LP ("Altimeter"). The information provided is believed to be from reliable sources but no liability is accepted for any inaccuracies. This is for information purposes and should not be construed as an investment recommendation. Past performance is no guarantee of future performance. Altimeter is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. Altimeter and its clients trade in public securities and have made and/or may make investments in or investment decisions relating to the companies referenced herein. The views expressed herein are those of the author and not of Altimeter or its clients, which reserve the right to make investment decisions or engage in trading activity that would be (or could be construed as) consistent and/or inconsistent with the views expressed herein.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.

26年,核心关注这么几件事情:1,AI会否摧毁搜索的商业模式。

2,没有网络效应的AI将演化出什么样的商业模式,或仅仅是极致好用的工具而吸引大部分人如浏览器一样。

3,waymoo上规模比较慢,会否被Robotaxi超车呢?中美谁能做出更好的体验。

4,AI将强化原有具头的优势,如果他们能将AI融合到现在的场景并做出好的体验,如微软,Meta,微信和字节。

5,跨平台的AI整合工具比较难,但是平台上的AI助手会初具雏形,如微信会在明年推出微信助手,苹果助手也值得小期待。

How about SMR? Nuclear Energy is huge and important for AI