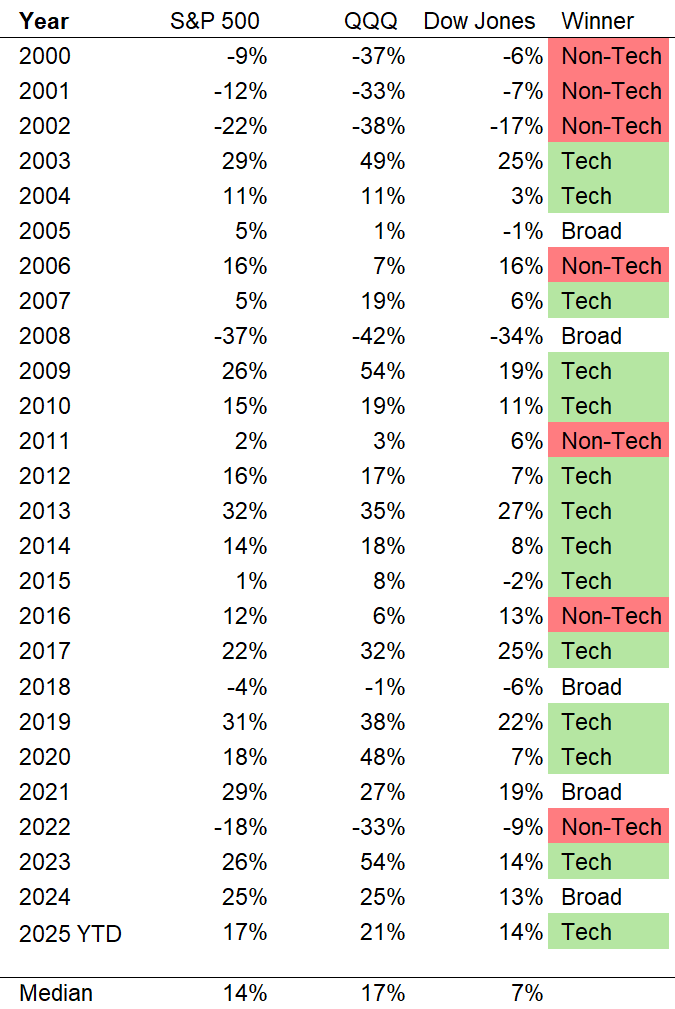

Tech vs. Non-Tech Returns

Historically, non-tech tends to outperform tech roughly once every ~4 years.

QQQ (Tech-heavy): Wins when markets are willing to pay up for future cash flows.

Tech outperforms in: falling or low rates, disinflation, easing liquidity, scarce growth, and strong secular tech earnings.Dow (Non-tech / value-heavy): Wins when markets favor near-term cash flows and dividends.

Non-tech outperforms in: rising rates, inflation or reflation, commodity and industrial strength, valuation mean reversion, and risk-off regimes.

Why Non-Tech Outperforms (Red Zones)

Non-tech sectors (Dow and value-heavy parts of the S&P 500) tend to lead when growth breaks or tech valuations reset.

Valuation Resets (2000–2002): During the dot-com bubble, tech traded at extreme multiples (often >100x P/E). When it burst, QQQ fell nearly ~80% peak-to-trough. Companies with tangible earnings and dividends held up far better.

Rate Shock (2022): The classic “tech wreck.” Surging inflation forced aggressive Fed tightening. Because tech valuations are dominated by long-duration cash flows, higher rates crushed present values - QQQ fell ~33%.

Value Rotations (2006, 2011, 2016): Cyclical leadership took over.

2006: Energy and financials surged alongside high oil prices and peak housing.

2016: The post-election reflation trade favored banks and industrials over software.