Industry 101 - EU vs US retail brokerage

EU has a smaller investor base (113M vs 166M in the US) and lower penetration (27% vs 62%).

EU brokerage is structurally more fragmented:

Trade Republic, the largest neo-broker, holds ~7% share; no single player exceeds 10%.

In the US: Schwab ≈37.4M accounts; Fidelity similar. HOOD has 26M funded accounts / 15M MAUs—~10% of US adults, ~⅔ Schwab’s base.

HOOD controls ~20–25% of “self-directed” retail and a bigger chunk of mobile-first flow.

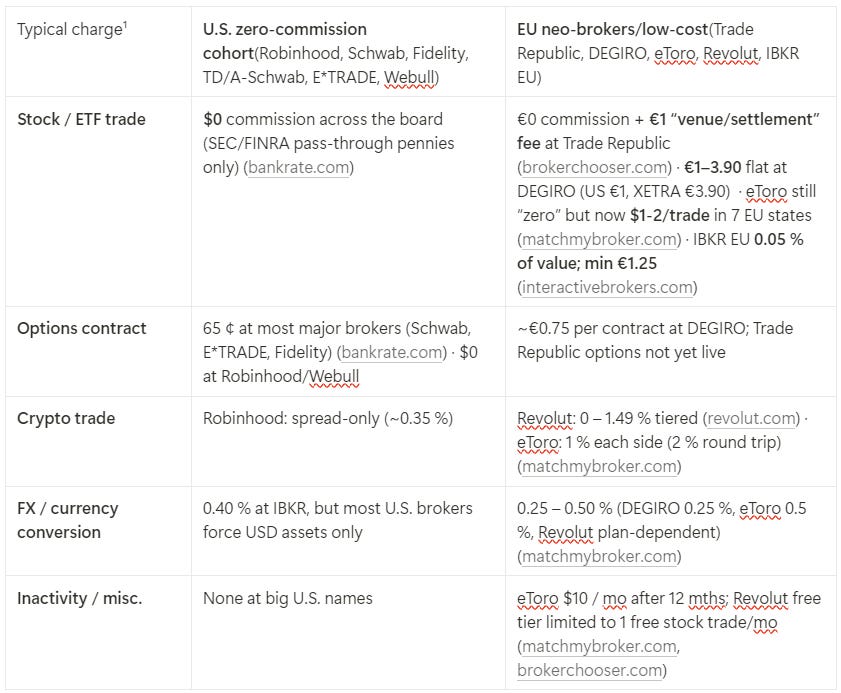

Europe is still 1.5–2 € more expensive per equity trade than the US. Options pricing is comparable (€0.75 ≈ $0.80).

PFOF (used to fund zero-fee trading) will be banned in the EU after mid-2026.

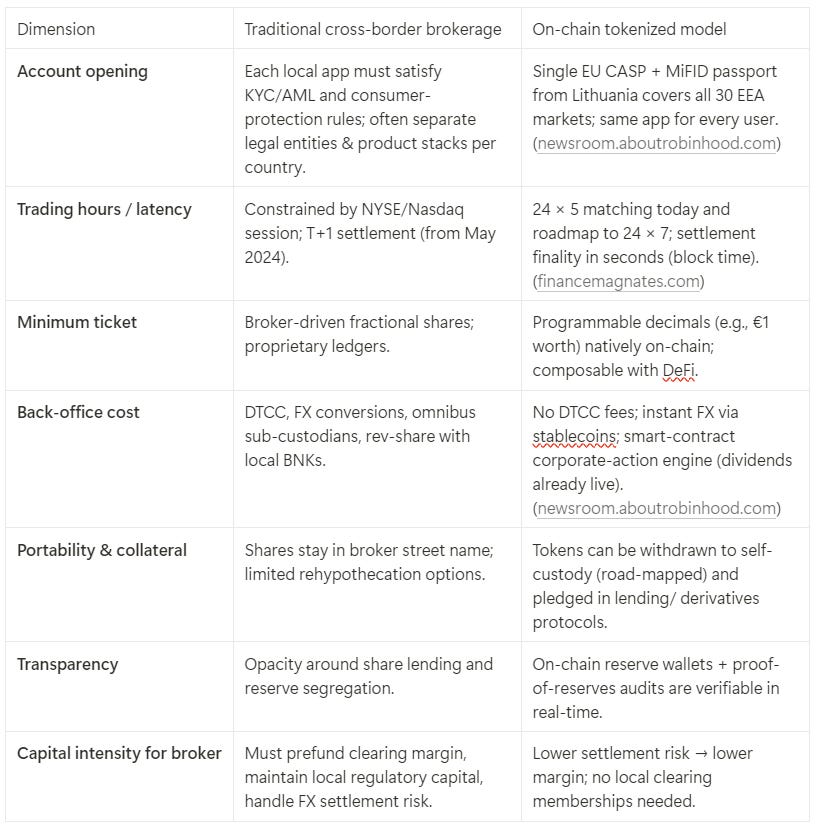

Why via Tokenized - Tokenized model vs. traditional brokerage

Speed: Tokenization fast-tracks EU rollout—runs under the lighter CASP regime, skipping legacy post-trade plumbing.

A traditional pan-EU broker takes 18–30 months and millions to build. Trade Republic needed 5 years to get a full banking license.

HOOD got a Lithuanian crypto license, launched stock tokens <6 months later—no CCPs, no CSDs, no multi-country filings.

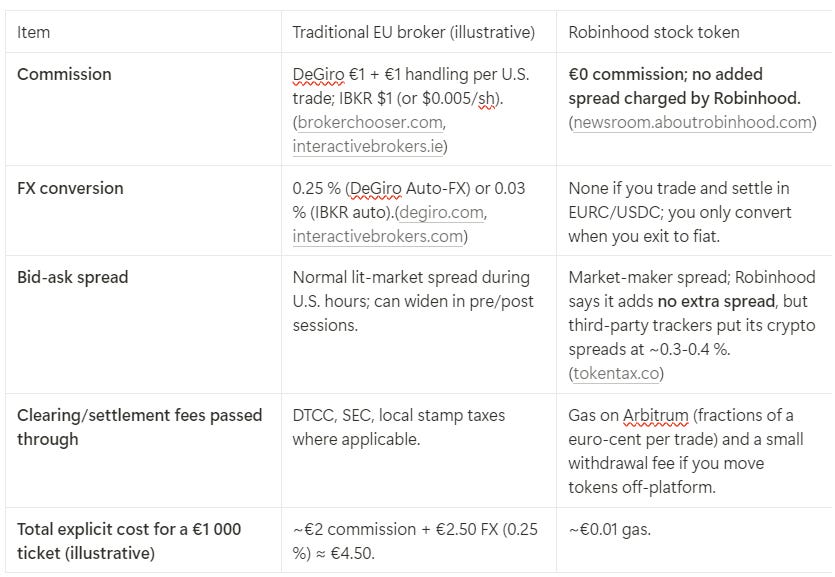

Cost: Gas + custody beats T2S + DTCC. Still zero-commission, but monetizes float + spread.

UX: 24×5 trading, fractional pennies, crypto-style instant settlement—stuff that Trade Republic, DeGiro, IBKR can’t easily support.

Strategic upside: Tokens plug into DeFi + RH’s own L2—enabling lending, staking, structured tokens, etc.

Hours: Traditional brokers go dark ~56 hrs/week + 8 hrs/night. HOOD’s tokens are live 24×5 (aiming for 24×7).

HOOD 0.00%↑ ’s Operations in EU

Dec ‘23: launched EU crypto app w/ 50+ coins

<1M funded accts so far. Bitstamp now holds full MiCA CASP license, passported EU-wide.

Jun 30 ‘25: launched tokenized US stocks + ETFs (200+) in 30 EEA countries

ERC-20 tokens on Arbitrum, w/ dividend passthrough, 24×5 trading, zero commissions

(Quick n Dirty) Quantifying the Upside

HOOD ARPU: $150 (on # of funded accounts) –$250 (on MAU)

Assuming 5M EU accounts × $200 ARPU = $1B revenue (vs. $930M in 1Q25 or $3.6B annualized)

No PFOF in EU—HOOD would need to monetizes via spread, float (ECB ≈ 4%), Gold subs, staking yield, and 10bps FX margin per stock-token roundtrip