HOOD | Options

Retail participation in U.S. markets has been extraordinary, and options trading is riding the same wave.

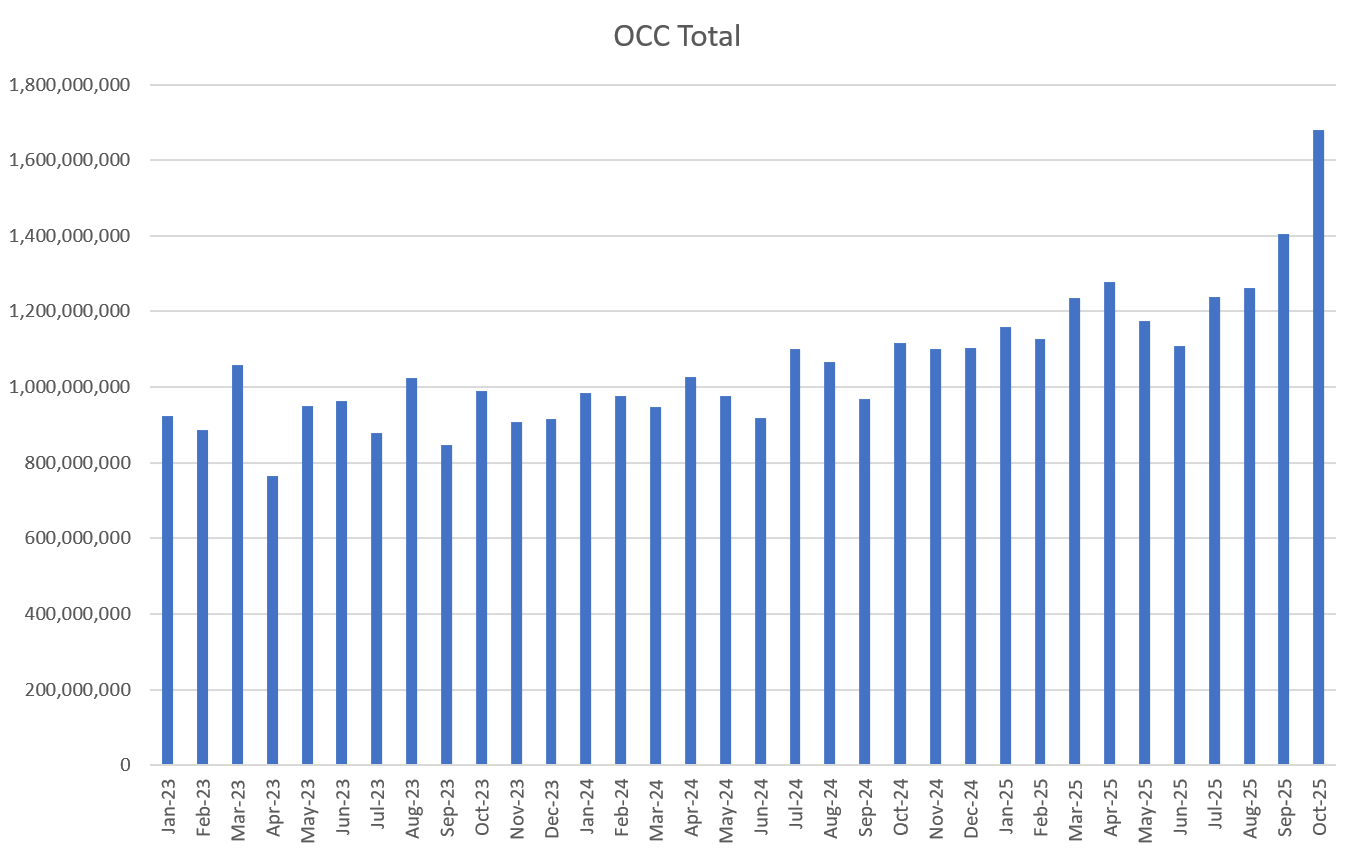

Total market options volume (Jan to Oct 2025) is up ~50% YTD, with SPX 0DTE contracts up ~62% YoY.

https://www.theocc.com/market-data/market-data-reports/volume-and-open-interest/monthly-weekly-volume-statistics

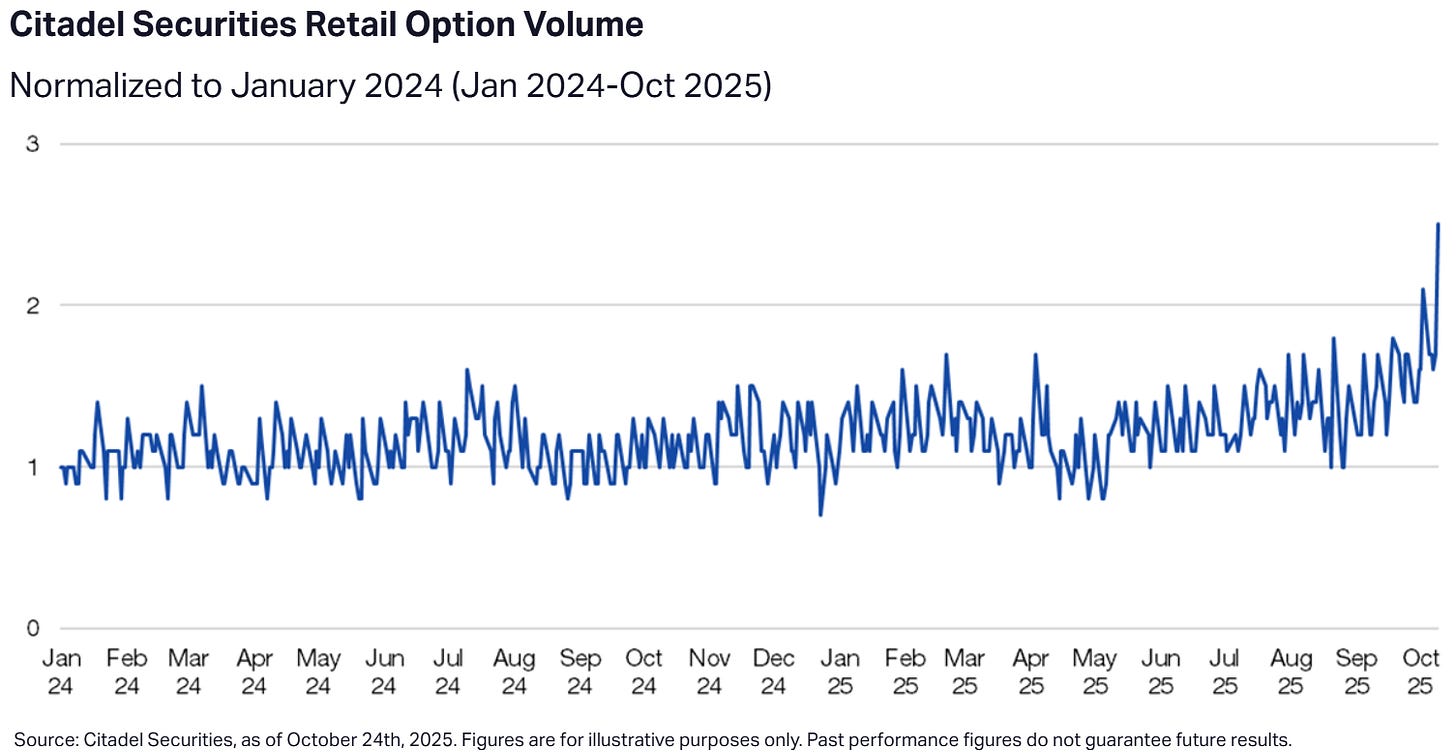

Retail option volume is now ~2.5× its January 2024 level (source: Citadel).

Retail ≈30%+ of total option contracts. Nasdaq’s chief economist estimates retail now accounts for “over 30%” of ADV (vs. ~10% pre-2020), driven by short-dated / 0DTE trading.

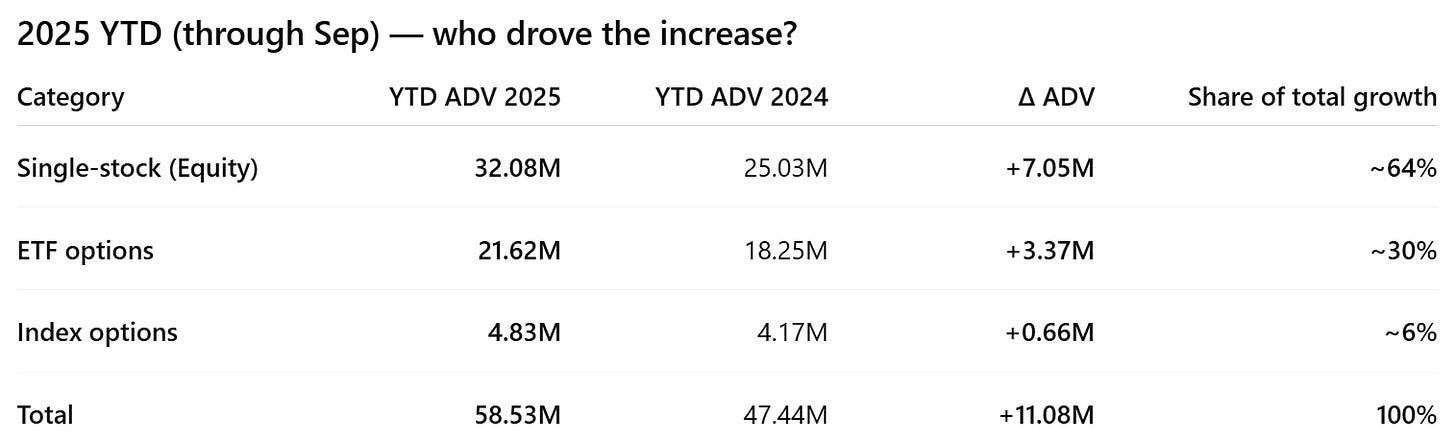

Market Composition (by ADV)

Single-stock options: ~55% (32.1M ADV)

ETF options: ~37% (21.6M ADV; e.g., SPY)

Index options: ~8% (4.8M ADV; e.g., SPX)

Within SPX, ~57–61% of volume is 0DTE

~50–60% of that flow is estimated retail (Cboe)

0DTE Landscape — Still Concentrated in SPX and Major ETFs

Overall share: Across all products, 0DTE options represent roughly 10–15% of total U.S. option contracts on a typical 2025 day (spiking higher on event days).

Within SPX: ~57–62% of all SPX trades in 2025 are 0DTE — up from ~40% in mid-2023 and ~50%+ by Q4’24.

SPX 0DTE ADV: ~1.6M/day (Q4’24) → ~2.15M (Q3’25) → ~2.7M (Oct ’25 record); single-day peak of ~6.4M contracts — a ~70% increase from late-2024 levels.

Cboe: SPX 0DTE volume has grown more than 5× in three years, with retail now accounting for ~50–60% of the flow.

Product Breakdown

SPX (Index Options): The dominant 0DTE venue — by Aug–Sep 2025, ~60% of SPX trades were same-day expiries. Within S&P-linked 0DTE (SPX vs. SPY vs. ES futures options), SPX captures ~77% of total contracts.

ETFs (SPY, QQQ, IWM, etc.): Daily expiries have made ETF 0DTE a large and growing segment. Activity extends beyond SPY/QQQ to products like GLD, SLV, TLT, UNG, and USO, which now list frequent 0DTE contracts.

Single-stock 0DTE: Still limited — most equities lack daily expiries, keeping volumes small relative to indexes and ETFs.

Key Drivers for Growth in Options

Explosion of 0DTE: Daily expirations (introduced 2022) unlocked intraday trading; by 2025, ~60% of SPX volume is same-day.

Macro hedging & event risk: CPI, Fed, earnings, and geopolitics have all spurred tactical hedging, driving SPX/VIX/NDX flows higher (Cboe, Reuters).

Extended trading hours: The move to near-24×5 SPX/VIX sessions brought in Asia/Europe flow, further boosting prints.

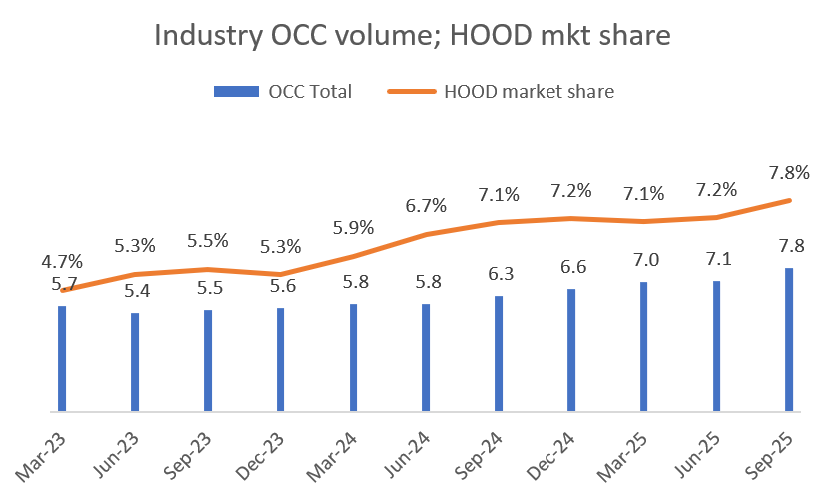

HOOD

No. of contracts (Bn)

Source: OCC; Robinhood public financials