HOOD 0.00%↑ and COIN 0.00%↑ have been two of the most fascinating stories in fintech — not just in terms of stock performance (13x and 11x since the bottom in 2022), but also revenue growth (3x and 5x FY2020-24A).

Yet I’ve heard plenty of pushback:

“It’s just a cyclical business.”

“It’s just beta — riding crypto or QQQ.”

So I’ve spent time thinking deeply about the nature of these businesses. This is a deep dive into:

Disentangling beta vs. alpha

Identifying the real revenue and cost drivers

Understanding what truly drives the stock

What Really Matters

This is an industry inherently tied to trading volumes and market volatility — in other words, it comes with built-in cyclicality. But within that, the market rewards differentiated business quality. Investors consistently look for:

Mitigated topline cyclicality via market share gains and pricing power

Mitigated bottom-line cyclicality via disciplined cost control

Mitigated topline cyclicality via true revenue diversification away from transactional volume

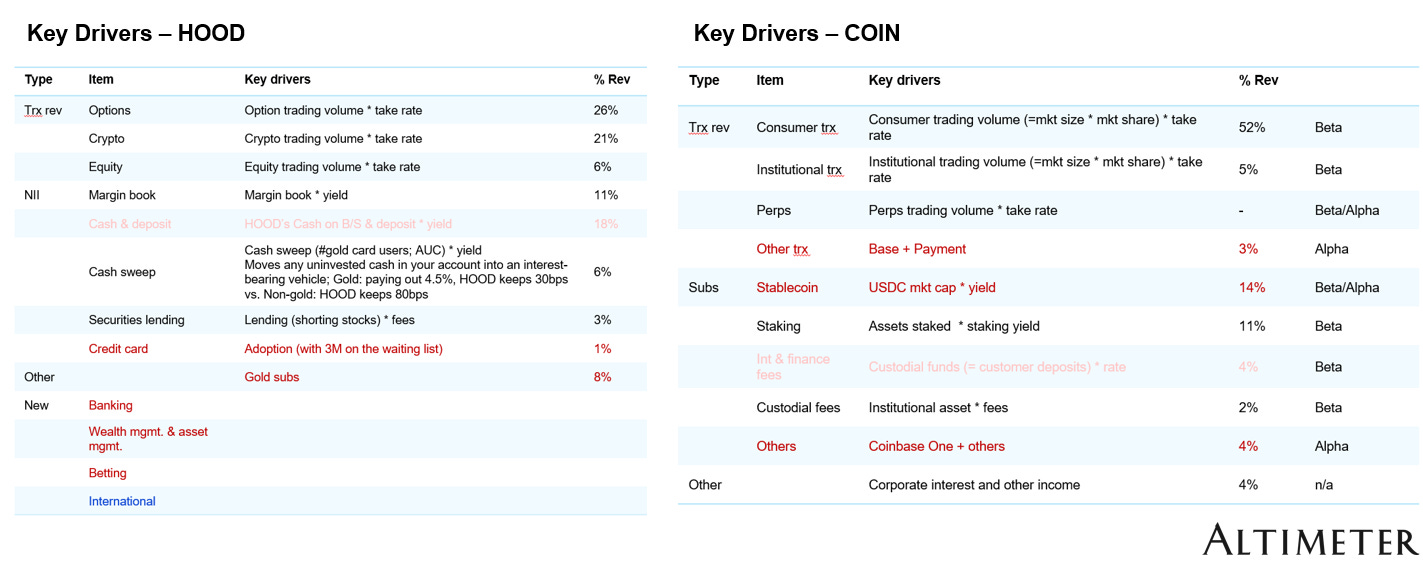

The Reality Today / Key Drivers

Both HOOD 0.00%↑ and COIN 0.00%↑ remain somewhat cyclical today — HOOD 0.00%↑ is tied to crypto + equities + options, while COIN 0.00%↑ is still overwhelmingly crypto.

Around 50%+ of revenue for both comes from transactional rev. Importantly, ~20% of COIN 0.00%↑ ’s revenue is detached from crypto trading volume, while only ~9% of HOOD 0.00%↑ ’s is detached from trading, and another ~18% is only loosely tied.

Revenue: Why COIN 0.00%↑ Shows Higher Cyclicality

Let’s break this down:

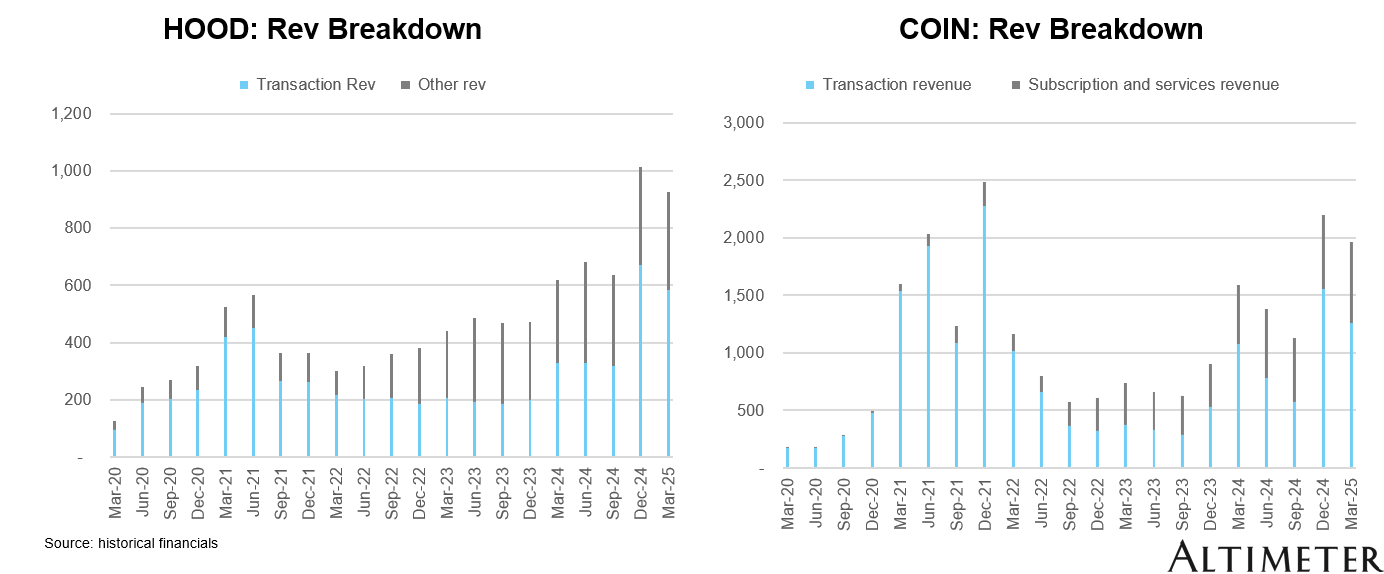

A. % of transactional vs. non-transactional revenue?

No — both have been increasing non-trx revenue, and COIN 0.00%↑ actually has more of it, growing faster.

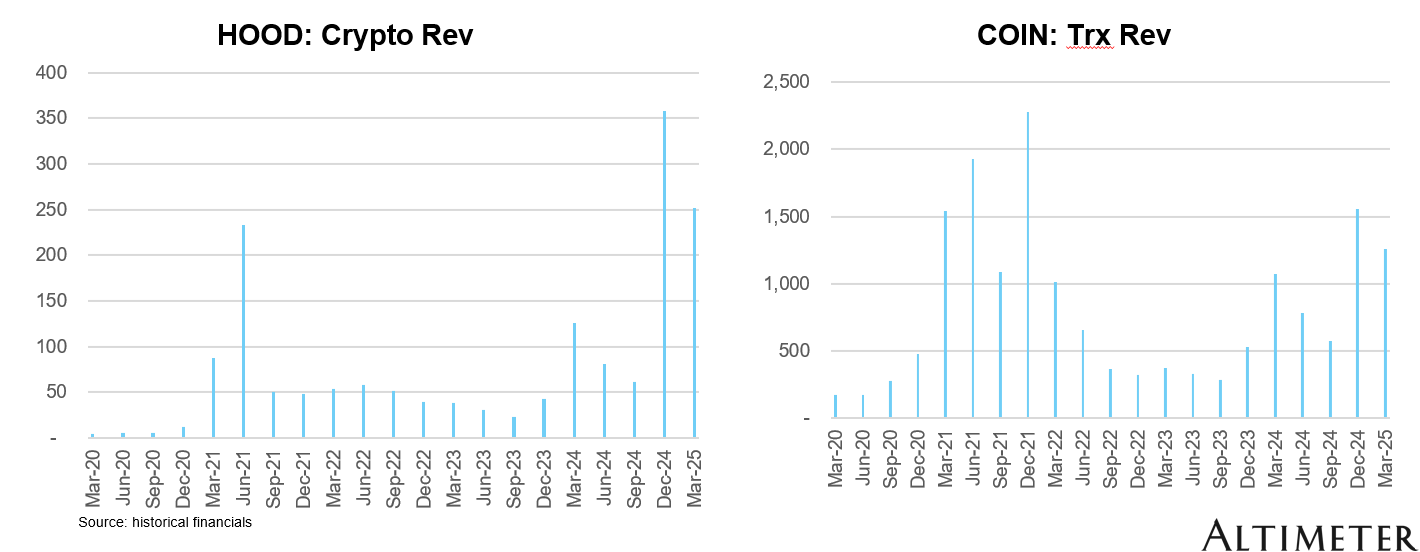

B. Transaction mix: COIN 0.00%↑ = pure crypto vs. HOOD 0.00%↑ = more diversified?

Partially. But HOOD 0.00%↑ ’s crypto revenue has already exceeded its 2021 peak. COIN 0.00%↑ ’s is still below.

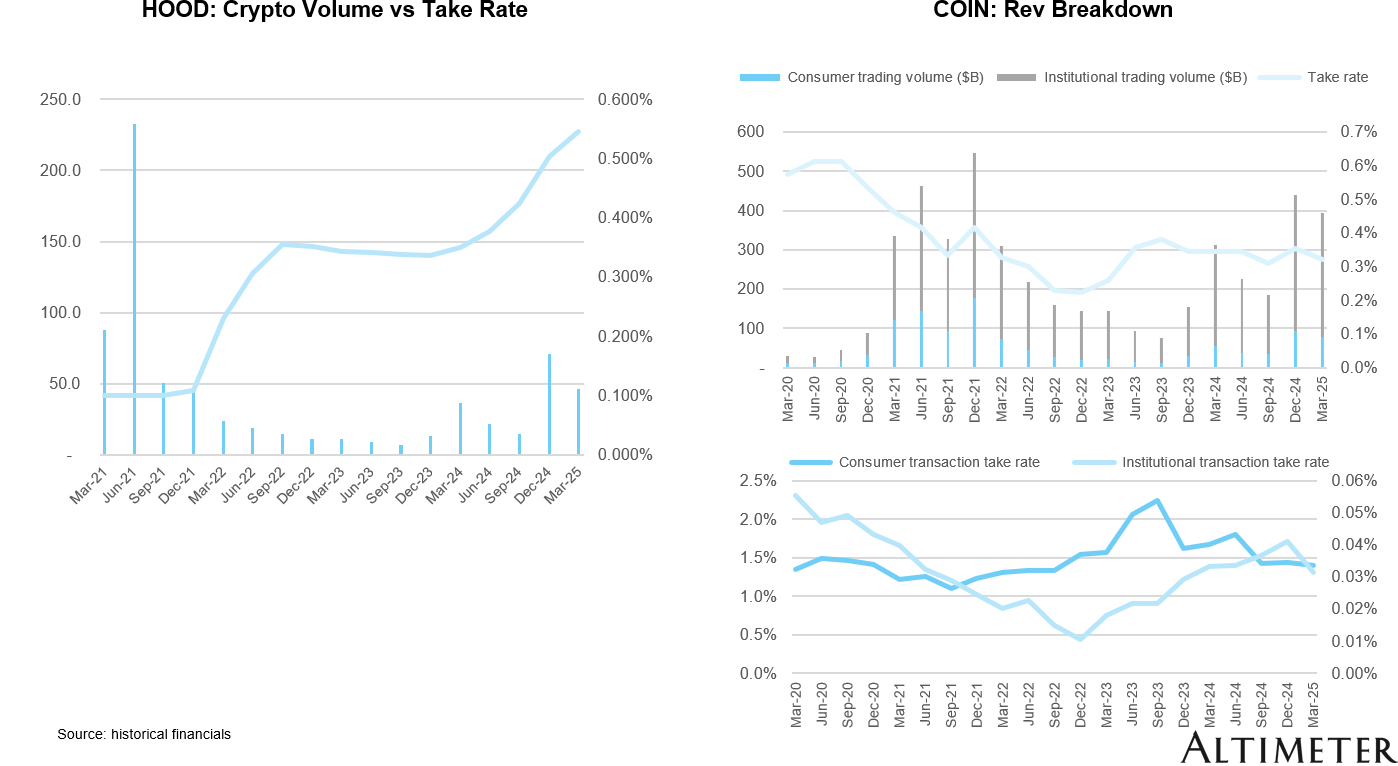

C. Within crypto, is it volume or take rate?

It’s the take rate.

HOOD 0.00%↑ ’s volume is well below 2021 levels, but revenue is up — all driven by higher take rate.

COIN 0.00%↑’s take rate is structurally challenged: 1) Higher institutional mix (3bps vs. consumer 150bps); 2) Consumer take rate is falling

→ Structural issue?

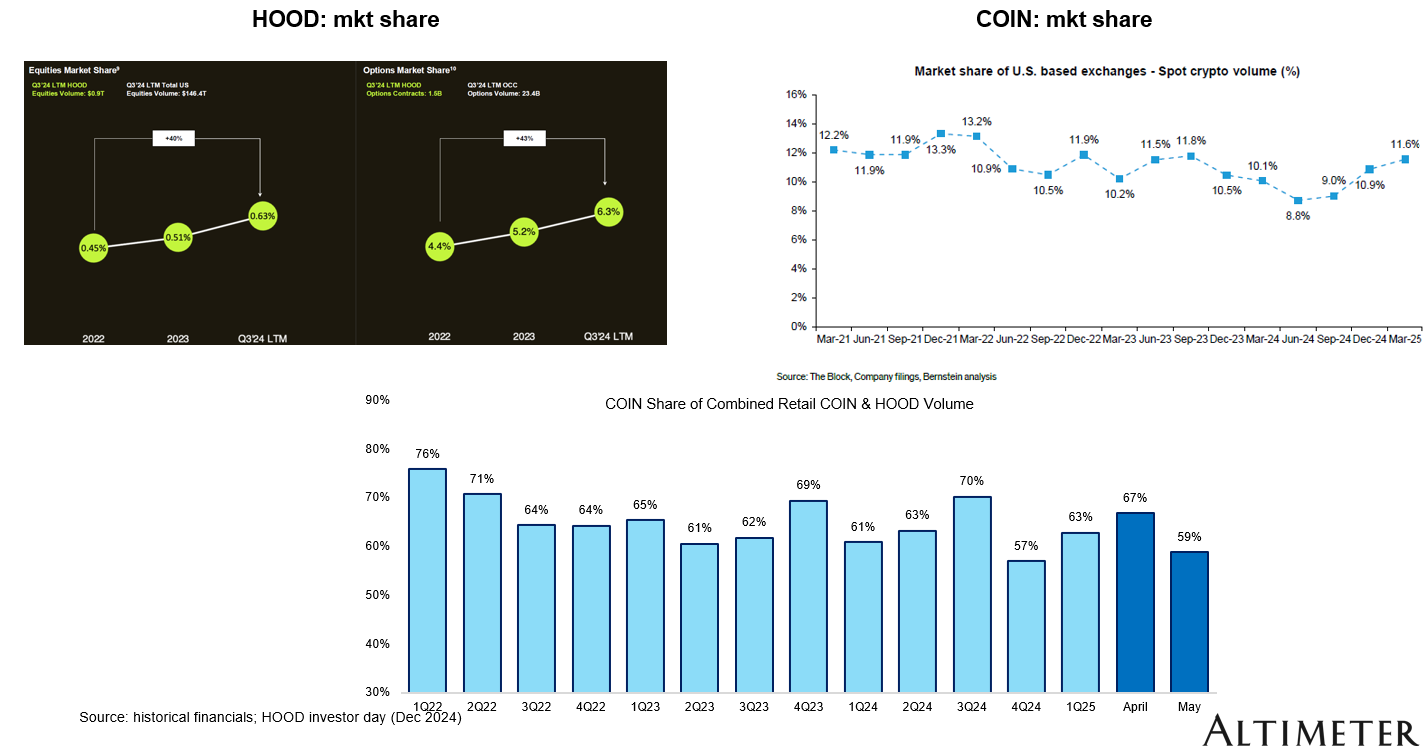

D. Market share trends?

Also relevant — I personally think it’s hard to value a business that's been losing share.

→ Structural issue?

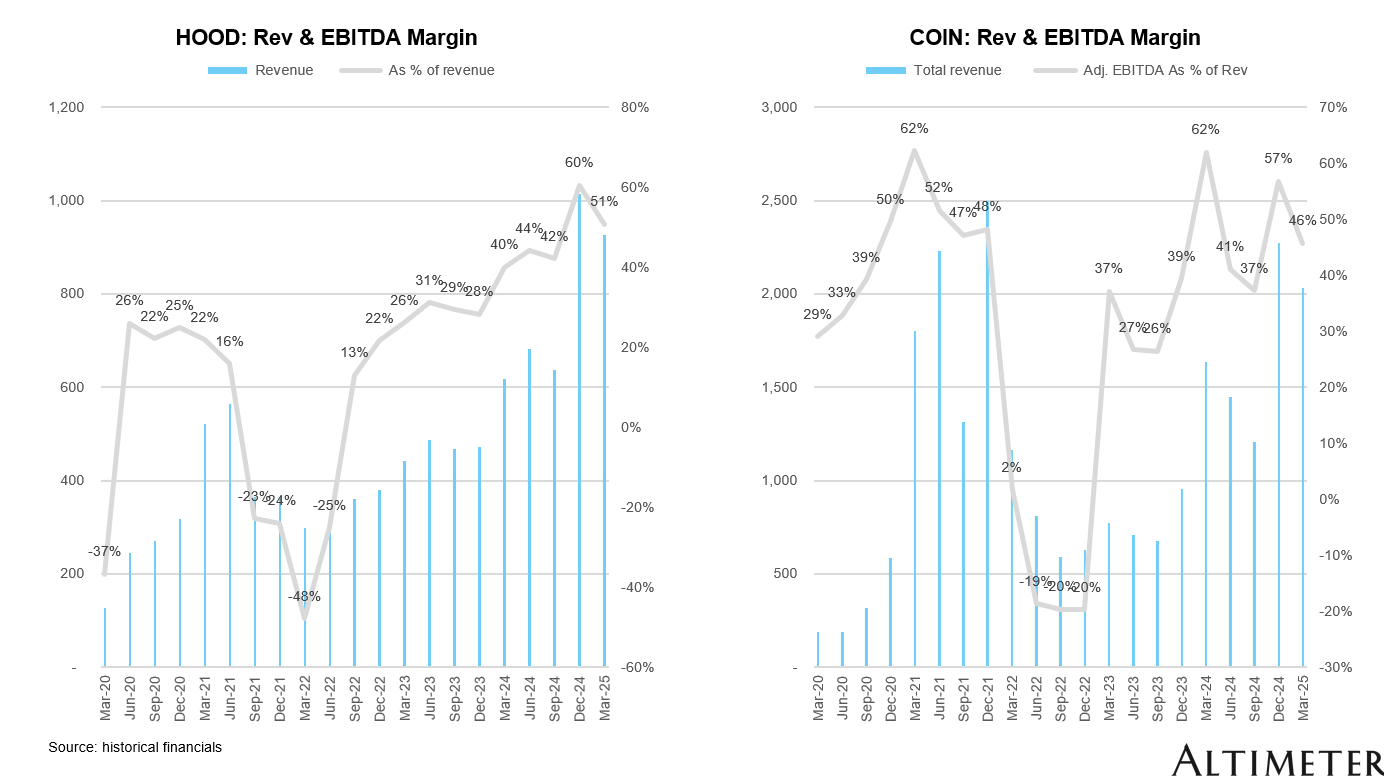

Cost: Where the Divergence Widens

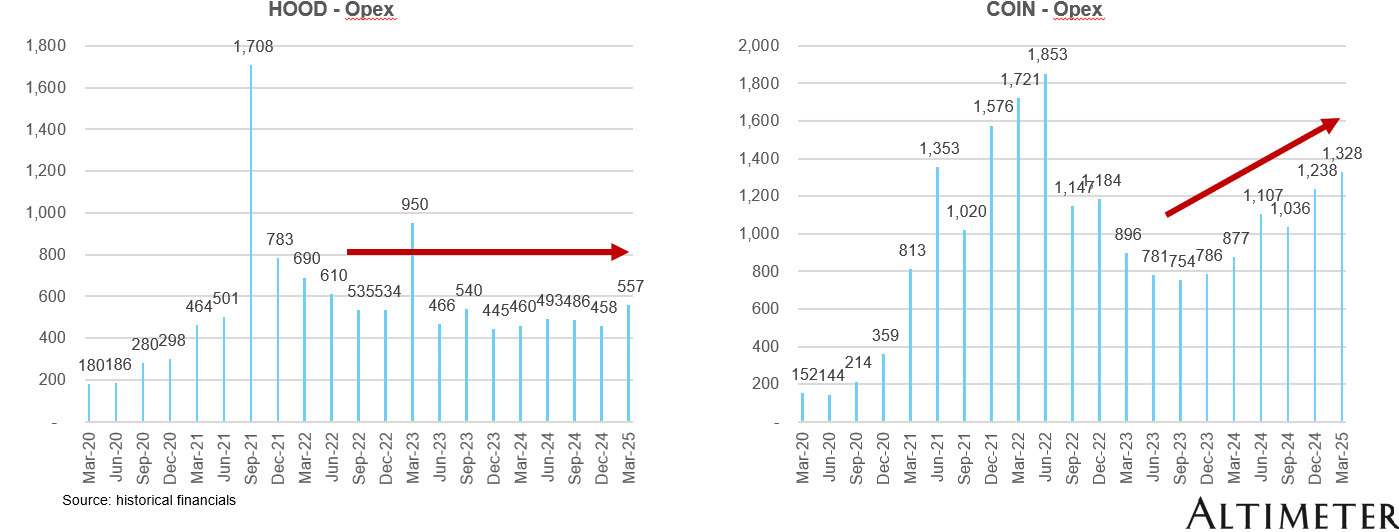

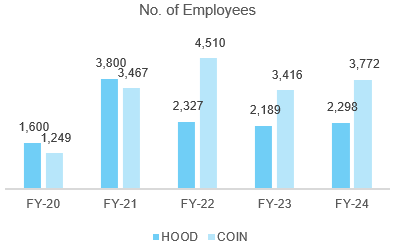

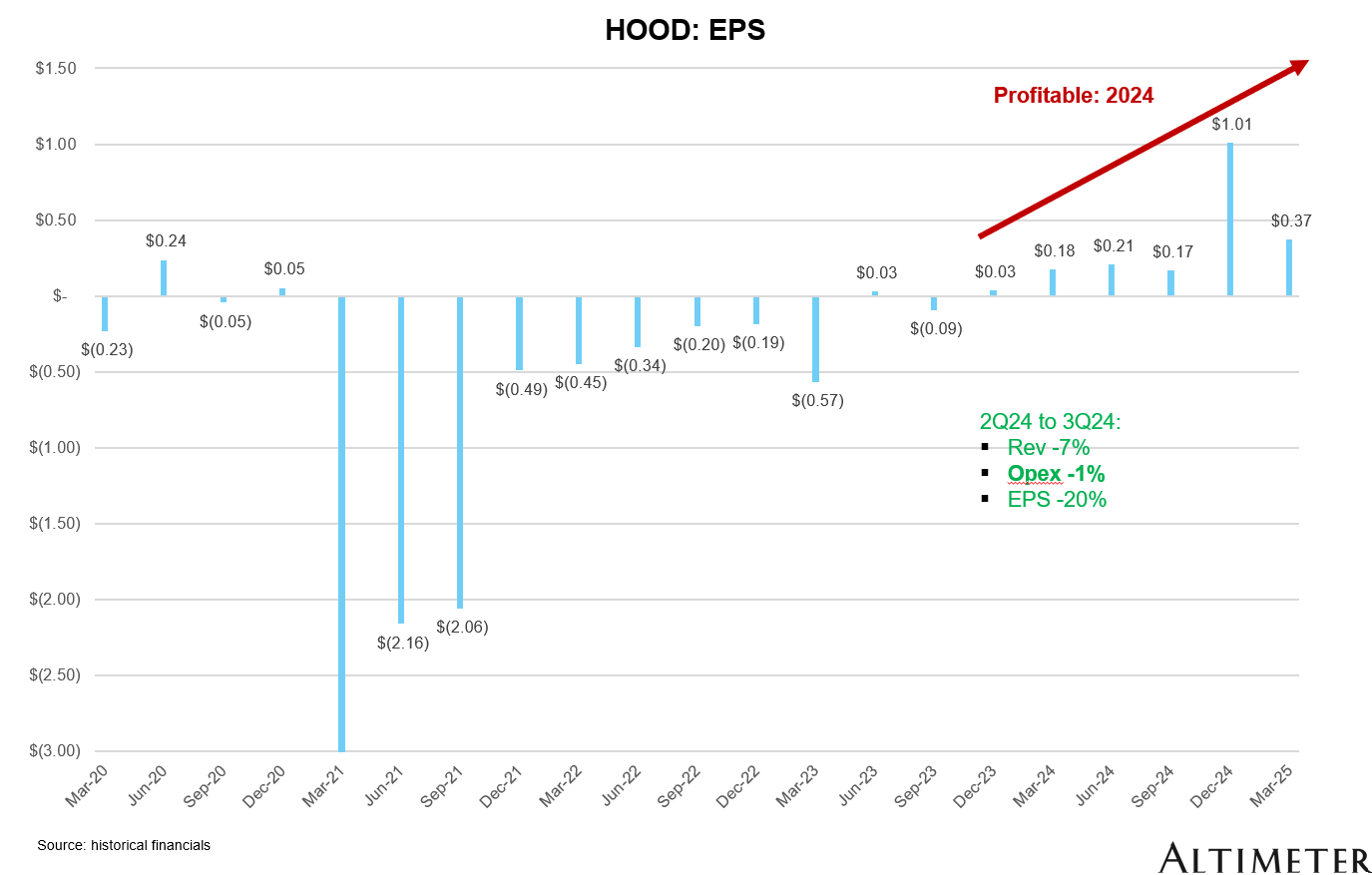

HOOD 0.00%↑ : Flat opex since Sept 2022 = remarkable operating leverage

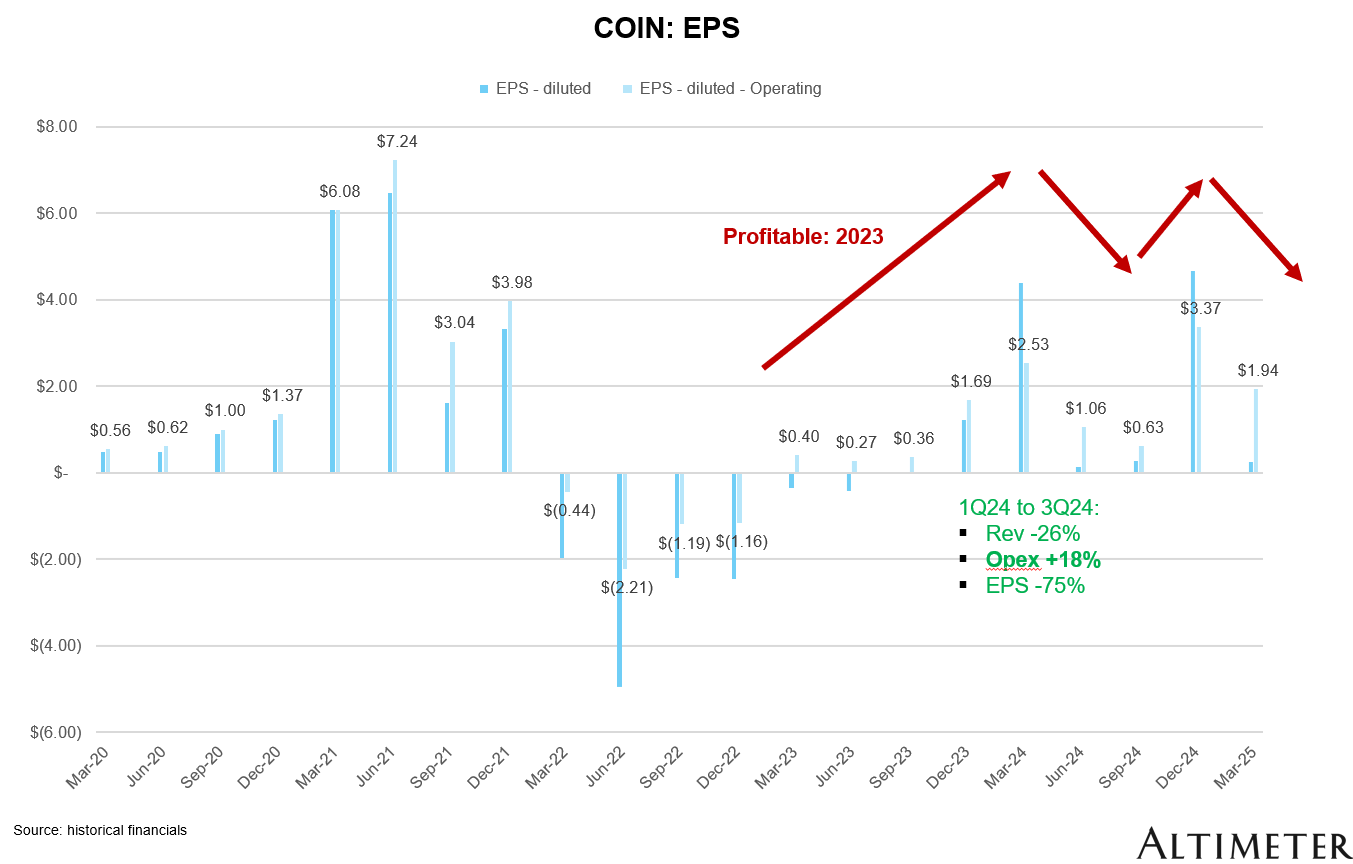

COIN 0.00%↑ : Opex up +60% from FY23 to FY25e, with headcount growth

This divergence shows up clearly in EPS volatility. Take a recent crypto drawdown as one example:

HOOD 0.00%↑ (2Q24 → 3Q24): Revenue -7%, Opex -1%, EPS -20%

COIN 0.00%↑ (1Q24 → 3Q24): Revenue -26%, Opex +18%, EPS -75%

Revenue: True Diversification Matters

When I say "true diversification," I mean revenue that’s not a derivative of trading volume (e.g., custodial fees depend on AUM, which is indirectly tied to trading volume - in my definition, this is not true diversification, but obviously people might have different views here).

COIN 0.00%↑ : Base, Payments, Coinbase One subs, USDC (maybe?)

HOOD 0.00%↑ : Credit card, Gold subs, Banking, Wealth/Asset Mgmt, Betting, International

Even putting cyclicality aside, it’s always better/easier to back a long that has multiple ways to win.

If You’ve Made It This Far — Here's the Bonus

What’s been driving stock performance?

One of my favorite analyses is relative performance: If COIN 0.00%↑ is $400/sh and HOOD 0.00%↑ is $100/sh, the ratio is 4x. A rising ratio = COIN 0.00%↑ outperforms; falling = HOOD 0.00%↑ outperforms.

2023: Strong COIN 0.00%↑ alpha

2024+: Strong HOOD 0.00%↑ alpha

What does this tell us?

1/ Margin > topline growth

2023: COIN 0.00%↑ stock +5x > HOOD 0.00%↑ +1.6x → COIN 0.00%↑ turned EPS profitable

(even though HOOD 0.00%↑ grew faster: +37% vs. COIN 0.00%↑ -3%)2024: HOOD 0.00%↑ stock +3x > COIN 0.00%↑ +1.6x → HOOD 0.00%↑ turned EPS profitable

(even though COIN 0.00%↑ grew faster: +111% vs. HOOD 0.00%↑ +58%)

I personally think one of the best times to invest in a stock is right when a business crosses into GAAP EPS profitability.

2/ EPS > EBITDA

Both names are valued on GAAP EPS. HOOD 0.00%↑ ’s EPS is cleaner (i.e. higher quality), vs. COIN 0.00%↑’s adjusted net income excl. crypto investment gains/losses and tax effects.

3/ HOOD 0.00%↑’s recent outperformance is largely due to cost discipline and hopes on rev diversification — exactly what the market rewards in cyclical businesses.

What Will Drive Alpha Going Forward?

It’s about the trifecta:

Business quality

Growth rate

Cyclicality mitigation

A Fun Exercise: HOOD 0.00%↑ & COIN 0.00%↑ vs. Benchmarks

HOOD 0.00%↑ vs. QQQ and HOOD 0.00%↑ vs. BTC: Both showing strong alpha

COIN 0.00%↑ vs. QQQ and COIN 0.00%↑ vs. BTC:

Surprising stat — Since mid-2022, COIN 0.00%↑ has NOT outperformed BTC meaningfully

Final Thought

This is a fascinating sector — riding powerful structural tailwinds with the potential to produce generational companies. At the end of the day, all stocks are valued on the same core pillars: growth, margin, and cyclicality. This industry scores well on the first two. The third — cyclicality — is the one to actively mitigate.

For names like these, where industry tailwinds are strong, it’s critical to separate industry beta from company-specific alpha. If a business doesn’t generate alpha, investors might be better off simply owning the pure beta — whether through crypto, QQQ, or other macro proxies.

So what creates alpha in this space?

Mitigated topline cyclicality through market share gains and pricing power

Mitigated bottom-line cyclicality through disciplined cost control

True revenue diversification (not just asset-linked pseudo-diversification)

The information presented in this newsletter is the opinion of the author and does not necessarily reflect the view of any other person or entity, including Altimeter Capital Management, LP ("Altimeter"). The information provided is believed to be from reliable sources but no liability is accepted for any inaccuracies. This is for information purposes and should not be construed as an investment recommendation. Past performance is no guarantee of future performance. Altimeter is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. Altimeter and its clients trade in public securities and have made and/or may make investments in or investment decisions relating to the companies referenced herein. The views expressed herein are those of the author and not of Altimeter or its clients, which reserve the right to make investment decisions or engage in trading activity that would be (or could be construed as) consistent and/or inconsistent with the views expressed herein.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.