It’s kind of wild how far we’ve come: Base’s Commerce Payments Protocol addresses nearly every major pain point that’s kept crypto out of mainstream commerce. This isn’t theory—it’s live, open-source, and real money is flowing.

Let’s break it down.

1/ Instant “yes/no” authorization

Merchants need to know: should I ship this item?

On-chain, that’s trivial. The protocol gives an immediate Authorized response by calling authorize(), which either succeeds or reverts. No polling. No ambiguity.

2/ Irrevocable or network-guaranteed funds

This is where the protocol shines most clearly compared to card networks. With traditional cards, “authorization” simply places a hold on credit—it’s a promise, not a payment. But in Base’s USDC rail, the authorize() call immediately moves the full transaction amount into an escrow smart contract. These funds are held securely and can only be released through a capture, refund, or void path defined by the protocol itself.

This replaces the concept of a “credit hold” with something more akin to a “debit hold”—the buyer’s balance is reduced instantly, yet the funds remain locked until the merchant captures them.

If a buyer lacks sufficient funds, the transferWithAuthorization call will revert with a standard ERC-20 error (transfer amount exceeds balance), causing the entire transaction to fail upfront. It’s equivalent to card error code 51: insufficient funds or credit limit.

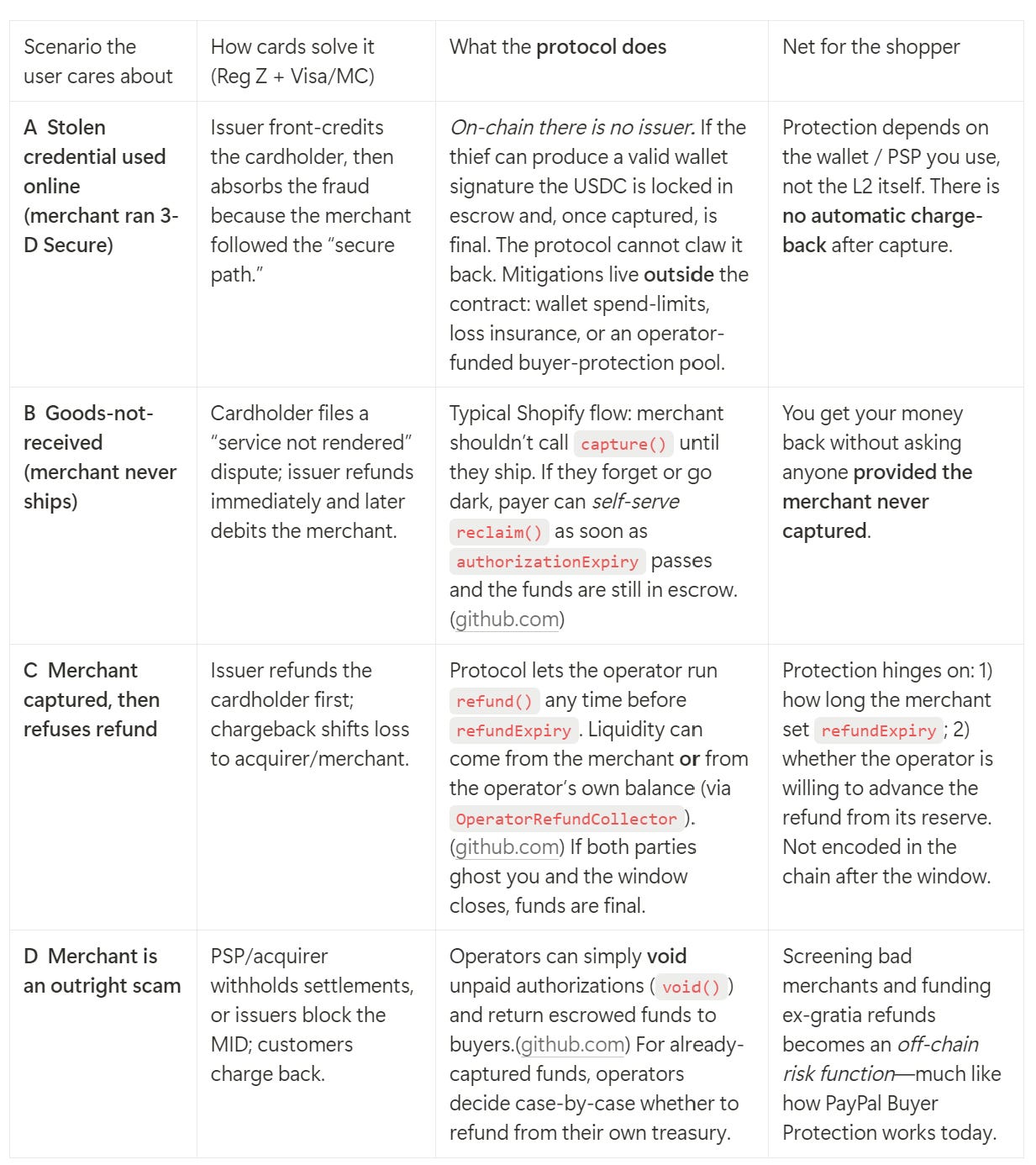

3/ Shopper protection, restructured

Unlike cards—where issuers bear statutory obligations to protect buyers—crypto-native payments shift consumer protections to the PSP or wallet layer.

The Base Commerce Protocol supports refunds via refund() calls, which can be executed using either the merchant’s wallet balance or, when that’s unavailable, the PSP’s own risk reserves.

The result is a system where consumer protection still exists, but it is no longer a matter of regulation—it becomes contractual and reputation-driven.

For example:

On day 0, the buyer pays, and funds move into merchant escrow.

By day 10, if the product fails to arrive, the buyer disputes. The PSP calls

refund()and retrieves the funds from the merchant’s balance—dispute closed.By day 65, if the merchant has disappeared and their balance is empty, the PSP may use its own risk fund.

By day 91, if the refund window has expired, on-chain refund is no longer possible. The PSP might offer an ex gratia credit, or the buyer may need to pursue resolution through Circle or legal avenues.

This model can’t replicate the statutory guarantees of traditional cards, but it provides meaningful recourse backed by smart contracts and financial incentives.

4/ Ubiquitous tooling and robust economic incentives

The final pillar of any successful payment rail is ecosystem maturity.

Base’s protocol supports modern, developer-friendly APIs and low-friction onboarding for merchants. The economics are sustainable: the rails are lean, yet they leave enough room for PSPs, wallets, and service providers to participate profitably.

One critical challenge remains: frictionless funding.

Today, stablecoin payments still require the buyer to source USDC, hold it in a wallet, and have ETH for gas. This user experience is far from optimal—but solvable.

A well-designed abstraction layer (whether built by Coinbase, Shopify, or an emerging fintech like MoonPay with its new stablecoin card) can bridge that final gap—bringing crypto rails to parity with cards not just on cost and finality, but also on ease of use.

What the ecosystem is building to remove those bumps

This has challenged many of my prior assumptions about how payment rails work. I’m genuinely impressed by the ecosystem that’s come together—much of it built in just the past few months, following (or anticipating) regulatory clarity.

The Base Commerce Protocol offers a compelling preview of a new kind of payment architecture: transparent, programmable, and structurally more efficient than the legacy systems we’ve grown used to.

As wallet UX, credit overlays, and fiat onramps continue to improve, crypto for commerce may arrive much sooner than expected.

Never underestimate what an open-source, programmable system can unlock.

https://github.com/base/commerce-payments/blob/main/docs/Fees.md

https://github.com/base/commerce-payments/blob/main/docs/README.md

https://blog.base.dev/commerce-payments-protocol

Coinbase <> SHOP interview: